If you’re looking to invest in the world’s largest and most liquid financial market, forex trading might be the way to go. Forex trading allows investors to buy and sell currencies from different countries, with the hope of profiting from the difference in exchange rates. However, forex trading can be complex and risky, especially for those without experience or expertise in the market.

Fortunately, there’s a solution for investors who want to invest in forex trading but lack the necessary knowledge or experience – PAMM accounts. In this article, we’ll explore what PAMM accounts are, their advantages, how they work, and factors to consider before investing in them.

Introduction:

-

Definition of PAMM Accounts

PAMM stands for Percentage Allocation Management Module. PAMM accounts allow investors to pool their funds together and have them managed by professional forex traders. Investors can choose to invest their funds in a PAMM account and have a professional fund manager trade on their behalf, while they sit back and watch their investments grow.

-

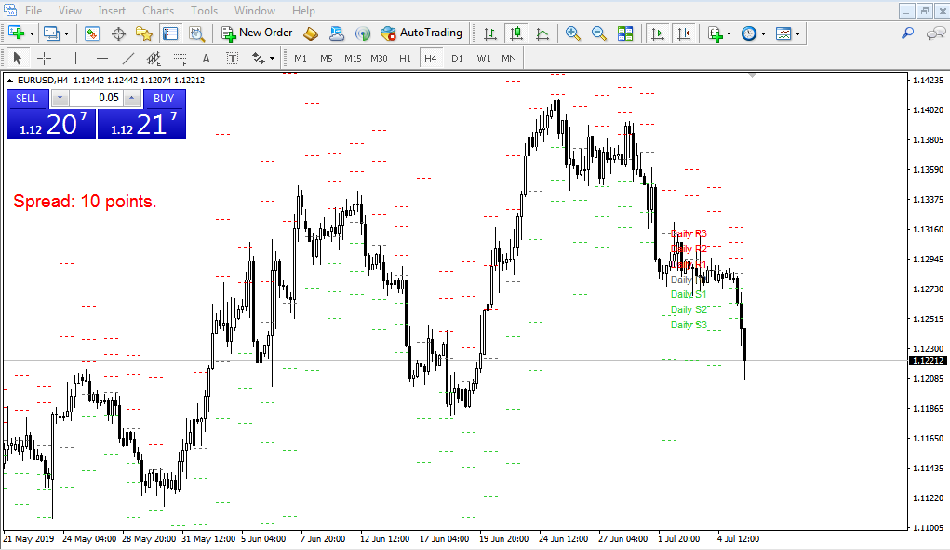

Brief Explanation of Forex Trading

Forex trading is the buying and selling of currencies from different countries. The forex market is the world’s largest financial market, with an average daily trading volume of over $5 trillion. Forex trading allows investors to profit from changes in exchange rates between different currencies.

Advantages of PAMM Accounts:

-

Expert Management

One of the biggest advantages of PAMM accounts is that they allow investors to benefit from the expertise of professional forex traders. Fund managers are experienced in analyzing the market and making trades that can generate significant profits for investors.

-

Low Investment Threshold

Investors can start investing in PAMM accounts with relatively small amounts of money. This allows more people to participate in forex trading and benefit from the potential profits it offers.

-

Diversification

By investing in a PAMM account, investors can diversify their portfolio across different currencies and trading strategies. This can help reduce the risk of losses in a single currency or strategy.

-

Transparent and Convenient

PAMM accounts are transparent and convenient, as investors can track the performance of their investments in real-time through a user-friendly interface. Investors can also withdraw their funds at any time, making PAMM accounts a flexible investment option.

How PAMM Accounts Work:

-

Investor’s Role

Investors choose a PAMM account to invest in and allocate their funds to it. The fund manager then uses these funds to trade currencies and generate profits. Profits and losses are allocated to investors based on their percentage share in the PAMM account.

-

Manager’s Role

The fund manager is responsible for managing the PAMM account and making trades on behalf of investors. Fund managers are experienced traders who analyze the market and make trades that are expected to generate profits. Fund managers are typically compensated through a percentage of the profits they generate for investors.

-

Allocation of Profits

Profits and losses are allocated to investors based on their percentage share in the PAMM account. For example, if an investor has allocated 10% of the total funds in a PAMM account, they will receive 10% of the profits or losses generated by the account.

Read more : About Trading Account Fund Management

Factors to Consider Before Investing in PAMM :

-

Risk Assessment

Investors should carefully assess the risks involved in investing in a PAMM account. Forex trading is a high-risk investment, and investors should be prepared to lose some or all of their investment.

-

Reputation of the Fund Manager

Investors should choose a reputable fund manager with a proven track record of generating profits for investors. It’s essential to do thorough research and due diligence before investing in a PAMM account. Investors can review the fund manager’s trading history, their experience, and their success rate in managing PAMM accounts.

-

Transparency and Accountability

Investors should choose a PAMM account that offers transparency and accountability. This includes regular updates on the account’s performance, detailed reports on trades made, and clear communication with investors.

Conclusion:

-

Recap of the Benefits of PAMM Accounts

PAMM accounts offer a revolutionary way to invest in forex trading, allowing investors to benefit from the expertise of professional fund managers while diversifying their portfolio and enjoying transparency and convenience. With low investment thresholds and the potential for significant profits, PAMM accounts can be a great investment option for those interested in forex trading.

-

Encouragement to Consider Investing in PAMM Accounts

If you’re interested in investing in forex trading but lack the knowledge or experience, PAMM accounts can be an excellent way to start. However, it’s essential to do your research, assess the risks involved, and choose a reputable fund manager. With careful consideration and the right approach, PAMM accounts can be a valuable addition to your investment portfolio.

Related Post:

How to Open a Forex Trading Account

The Psychological Pitfalls of Forex Trading : Overcoming Fear, Greed, and Emotion in the Market