The GBPAUD currency pair trading analysis involves buying or selling the British Pound (GBP) against the Australian Dollar (AUD) in the foreign exchange (forex) market. Here are some key points to consider when trading the GBPAUD Currency Pair Trading Analysis :

Factors Affecting GBP/AUD:

Economic Indicators:

Pay attention to economic indicators from both the UK and Australia, such as GDP growth, employment data, inflation rates, and interest rates. These can significantly impact currency values.

Interest Rates:

Central banks’ interest rate decisions influence currency values. Higher interest rates in one country relative to another may attract more foreign capital and strengthen its currency.

Political Stability:

Political stability and economic policies in both the UK and Australia can affect the currency pair. Political uncertainty may lead to volatility in the forex market.

Trade Balance:

Consider the trade balances of both countries. A trade surplus in one country can strengthen its currency.

Commodity Prices:

Australia is a major commodity exporter. Changes in commodity prices, especially in key exports like iron ore and coal, can impact the Australian Dollar.

Technical Analysis:

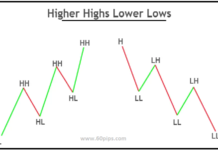

Charts and Trends:

Use technical analysis tools and charts to identify trends, support/resistance levels, and potential entry/exit points.

Volatility:

Be aware of the historical volatility of the currency pair. High volatility can present both opportunities and risks.

Moving Averages:

Moving averages can help identify trends and potential trend reversals. For example, a crossover of short-term moving averages above long-term moving averages may signal an upward trend.

Risk Management:

Stop-Loss Orders:

Set stop-loss orders to limit potential losses in case the trade moves against you.

Position Sizing:

Determine the size of your position based on your risk tolerance and the volatility of the currency pair.

Diversification:

Consider diversifying your trading portfolio to spread risk across different currency pairs and assets.

News and Events:

Economic Calendar:

Stay informed about economic events and releases through an economic calendar. Major announcements can impact currency values.

Central Bank Announcements:

Pay attention to statements and decisions from the Bank of England (BoE) and the Reserve Bank of Australia (RBA).

Continuous Learning:

Stay Informed:

Keep abreast of global economic developments and geopolitical events that may impact the forex market.

Educational Resources:

Continuously educate yourself about forex trading strategies, market analysis, and risk management.

Remember that trading involves risk, and it’s essential to conduct thorough research and, if possible, seek advice from financial professionals before making trading decisions. Additionally, past performance is not indicative of future results in the forex market. GBPAUD Currency Pair Trading Analysis is as follows by today-

- There is no clear indication that the upward move is coming to an end.

- Trend line support is located at 1.9225.

- We expect a reversal in this move.

- Risk/Reward would be poor to call a buy from current levels.

- A move through 1.9250 will confirm the bullish momentum.

Recommendations: Buy/Buy limit @ 1.92100 Take Profit: 1.93200

Related Post:

How to start Forex and CFD trading