Margin and leverage are two key concepts in forex trading that are crucial to understand in order to be successful in the market. While both offer potential rewards, they also come with significant risks. Here are some tips to help traders navigate margin and leverage in forex.

What is Margin?

Margin is the amount of money that a trader needs to have in their account in order to open a position. It acts as a form of collateral for the trade, and is held by the broker until the position is closed. Margin requirements vary depending on the broker and the currency pair being traded, but typically range from 1% to 5% of the total trade value.

Tip 1: Always Know Your Margin Requirement

Before entering a trade, it’s important to know the margin requirement for that currency pair. This will help you calculate how much margin you need to have in your account in order to open the trade. Failing to meet the margin requirement can result in a margin call, which is when the broker requires you to deposit more funds into your account to maintain the position.

Tip 2: Use Margin Wisely

While margin can increase potential profits, it also amplifies losses. Therefore, it’s important to use margin wisely and avoid overleveraging your account. It’s generally recommended to limit your margin usage to no more than 10% of your account balance.

What is Leverage?

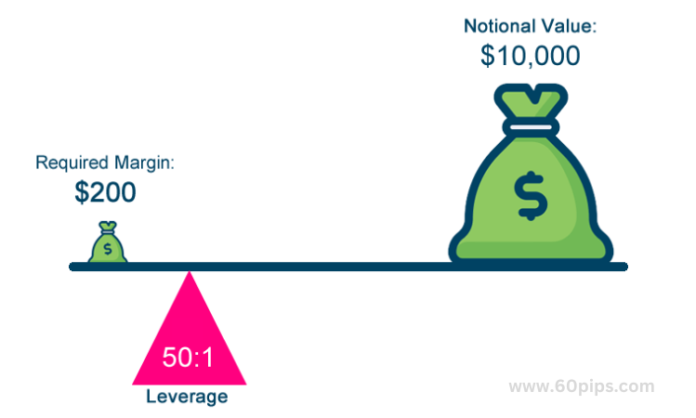

Leverage is the amount of money that a trader can borrow from their broker to open a larger position than they could with their own funds. It’s expressed as a ratio, such as 50:1 or 100:1, and represents the amount of leverage available. For example, with 50:1 leverage, a trader can control $50 for every $1 they have in their account.

Tip 3: Understand the Risks of Leverage

While leverage can magnify potential profits, it also magnifies losses. Traders should understand the risks of leverage and use it wisely. It’s generally recommended to use low leverage, such as 10:1 or 20:1, especially for beginners.

Tip 4: Don’t Overextend Your Leverage

It can be tempting to use high leverage to open larger positions, but this can be risky. Overextending your leverage can lead to large losses and even wipe out your entire account. It’s important to use leverage wisely and only open positions that you can afford to lose.

Final Thoughts

Margin and leverage are important concepts in forex trading that can increase potential profits, but also come with significant risks. It’s important for traders to understand these concepts and use them wisely. By knowing your margin requirements, using margin and leverage wisely, and avoiding overleveraging, you can navigate these concepts and increase your chances of success in the forex market.

Related Post:

Beginner’s Guide to Forex Trading: Tips and Strategies for Successful Trading