XAU/USD is the ticker symbol for the spot price of gold in relation to the US dollar. Trading XAU/USD involves speculating on the price movements of gold against the US dollar. There are several ways to trade XAU/USD, including:

- Spot Market: This is where gold is bought or sold for immediate delivery at the current market price.

- Futures Market: This is where gold is bought or sold at a future date, at a predetermined price.

- Exchange-Traded Funds (ETFs): ETFs are investment funds that track the price of gold and can be bought and sold on the stock market.

- Options: Options give the buyer the right, but not the obligation, to buy or sell gold at a predetermined price and date.

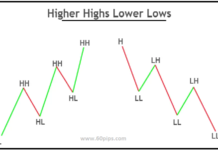

When trading XAU/USD, it is important to conduct thorough analysis and risk management to make informed trading decisions. Factors that may impact the price of gold include economic indicators, global events, geopolitical tensions, and central bank policies. Today’s trading overview as follows:

- We have posted an inside Harami candle on the daily chart. A clear sign of investor indecision.

- A bullish reverse Head and Shoulders is forming.

- Bespoke support is located at 1981.

- The formation has a measured move target of 2041.

- Dip buying offers good risk/reward.

Recommendation: Buy/Buy limit @ 1990 Take Profit: 2040

Related Post:

Traders Praise Blackbullmarkets Transparency and Low Fees in Latest Broker Review