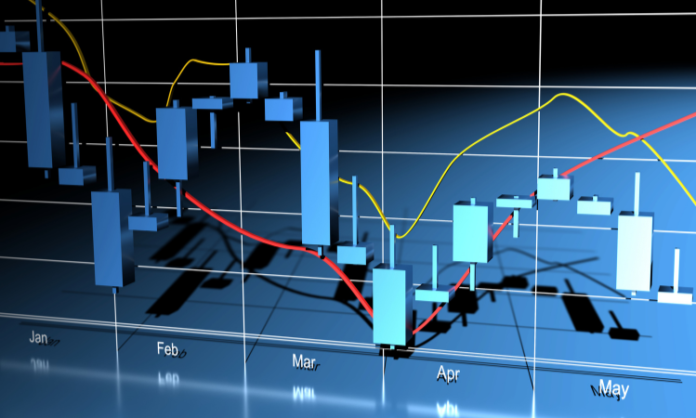

Forex trading is a dynamic and lucrative market that attracts traders from all over the world. However, trading in the forex market can be risky if one does not have a successful forex trading strategy in place. There are three main types of trading strategies that traders use to make trading decisions, and they are technical analysis, fundamental analysis, and risk management. In this article, we will discuss these three trading strategies and how they can be used to achieve success in the forex market.

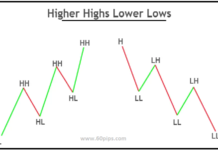

Technical Analysis Strategy:

Technical analysis is a trading strategy that involves studying charts and using technical indicators to identify trading opportunities. The key concept of technical analysis is that historical price movements can provide insights into future price movements. Technical analysis uses chart patterns, trend analysis, indicators, and oscillators to identify trading opportunities. Popular technical analysis tools include moving averages, Relative Strength Index (RSI), Bollinger Bands, and MACD.

Technical analysis has several advantages. It is a simple and straightforward trading strategy that is easy to understand and implement. Additionally, technical analysis can provide traders with objective trading signals that are based on data and not influenced by emotions. However, technical analysis has its disadvantages. Technical analysis cannot predict sudden market shifts or news events, and it relies on past performance, which may not always be an accurate predictor of future performance.

Fundamental Analysis Strategy:

Fundamental analysis is a successful trading strategy that involves analyzing economic indicators, news releases, and central bank policy to determine the intrinsic value of a currency. The key concept of fundamental analysis is that a country’s economic and political conditions can impact the value of its currency. Fundamental analysis uses economic indicators such as Gross Domestic Product (GDP), inflation rates, and employment rates, as well as news releases and central bank policy decisions to identify trading opportunities.

Fundamental analysis has several advantages. It can provide traders with a long-term perspective on currency values and can help traders understand the underlying causes of price movements. Additionally, fundamental analysis can help traders identify macroeconomic trends that can influence currency values. However, fundamental analysis has its disadvantages. Fundamental analysis requires a deep understanding of economic and political conditions, and it may not provide traders with precise entry and exit points for trades.

Risk Management Strategy:

Risk management is a trading strategy that involves managing risk by using various tools to control losses. The key concept of risk management is that traders should focus on preserving capital by limiting their losses. Risk management tools include position sizing, stop-loss orders, and risk-reward ratios. Position sizing involves determining the appropriate trade size based on the trader’s account size and risk tolerance. Stop-loss orders are used to close out trades automatically when a predetermined price level is reached. The risk-reward ratio is a measure of the potential reward compared to the potential loss of a trade.

Risk management has several advantages. It can help traders avoid large losses and protect their capital. Additionally, risk management can help traders manage their emotions by removing the need to make impulsive decisions. However, risk management has its disadvantages. Strict risk management rules can limit potential gains, and stop-loss orders may be triggered prematurely, resulting in missed profits.

Combining Strategies:

Traders can combine technical and fundamental analysis, as well as risk management strategies, to achieve their trading goals. By using multiple strategies, traders can create a more robust trading plan that takes into account both short-term and long-term factors. For example, a trader might use technical analysis to identify short-term trading opportunities and use fundamental analysis to determine long-term trends. Risk management can then be used to manage losses and protect capital.

Conclusion:

Successful forex trading requires a sound trading strategy. Technical analysis, fundamental analysis, and risk management are three main types of trading strategies that traders can use to achieve success in the forex market. Each strategy has its advantages and disadvantages, and traders should choose a regulated forex broker for sound trading.

Click to Sign up with MonetaMarkets

Related Post:

Beginner’s Guide to Forex Trading: Tips and Strategies for Successful Trading