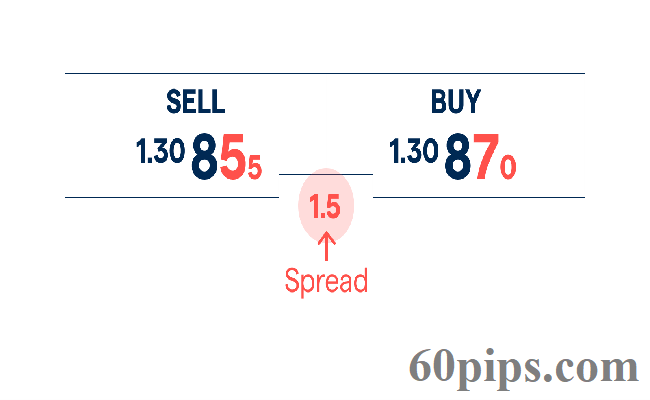

Forex brokers will quote you two different prices for a currency pair: the bid and ask price. The “bid” is the price at which you can SELL the base currency. The “ask” is the price at which you can BUY the base currency. The difference between these two prices is known as the Spread in Forex Trading.

Also known as the “bid/ask spread“. The spread is how “no commission” brokers make their money. This spread is the fee for providing transaction immediacy. This is why the terms “transaction cost” and “bid-ask spread” are used interchangeably.

Instead of charging a separate fee for making a trade, the cost is built into the buy and sell price of the currency pair you want to trade.

From a business standpoint, this makes sense. The broker provides a service and has to make money somehow.

- They make money by selling the currency to you for more than they paid to buy it.

- And they also make money by buying the currency from you for less than they will receive when they sell it.

- This difference is called the spread.

What Types of Spreads are in Forex?

The type of spreads that you’ll see on a trading platform depends on the forex broker and how they make money. There are two types of spreads:

- Fixed

- Variable (also known as “floating”)

What are the Advantages of Trading With Fixed Spreads?

- Fixed spreads have smaller capital requirements, so trading with fixed spreads offers a cheaper alternative for traders who don’t have a lot of money to start trading with.

- Trading with fixed spreads also makes calculating transaction costs more predictable.

- Since Spread in Forex Trading never change, you’re always sure of what you can expect to pay when you open a trade.

What are the Disadvantages of Trading With Fixed Spreads?

Requotes can occur frequently when trading with fixed spreads since pricing is coming from just one source (your broker).

And by frequently, we mean almost as frequently as Instagram posts from Kardashian sisters!

There will be times when the forex market is volatile and prices are rapidly changing. Since spreads are fixed, the broker won’t be able to widen the spread to adjust for current market conditions.

So if you try to enter a trade at a specific price, the broker will “block” the trade and ask you to accept a new price. You will be “re-quoted” with a new price.

The requote message will appear on your trading platform letting you know that price has moved and asks you whether or not you are willing to accept that price. It’s almost always a price that is worse than the one you ordered.

Slippage is another problem. When prices are moving fast, the broker is unable to consistently maintain a fixed spread and the price that you finally end up after entering a trade will be totally different than the intended entry price.

Slippage is similar to when you swipe right on Tinder and agree to meet up with that hot gal or guy for coffee and realize the actual person in front of you looks nothing like the photo.

What are Variable Spreads in Forex?

As the name suggests, variable spreads are always changing. With variable spreads, the difference between the bid and ask prices of currency pairs is constantly changing.

Variable spreads are offered by non-dealing desk brokers. Non-dealing desk brokers get their pricing of currency pairs from multiple liquidity providers and pass on these prices to the trader without the intervention of a dealing desk. This means they have no control over the spreads. And spreads will widen or tighten based on the supply and demand of currencies and the overall market volatility.

Typically, spreads widen during economic data releases as well as other periods when the liquidity in the market decreases (like during holidays and when the zombie apocalypse begins).

Related Post:

About Forex PIP

Lower Low and Lower High in Forex Trading

Our Account Management Feature