Trendline trading strategy is a popular strategy used in technical analysis to identify and trade in the direction of a prevailing market trend. This strategy is based on the idea that financial markets tend to move in trends, and by drawing trendlines on price charts, traders can potentially spot entry and exit points for profitable trades. Here’s a step-by-step guide on how to implement a trendline trading strategy:

Select the Timeframe: Start by choosing a timeframe that suits your trading style and goals. Longer timeframes (daily, weekly) are suitable for swing traders and investors, while shorter timeframes (hourly, 15 minutes) are more appropriate for day traders.

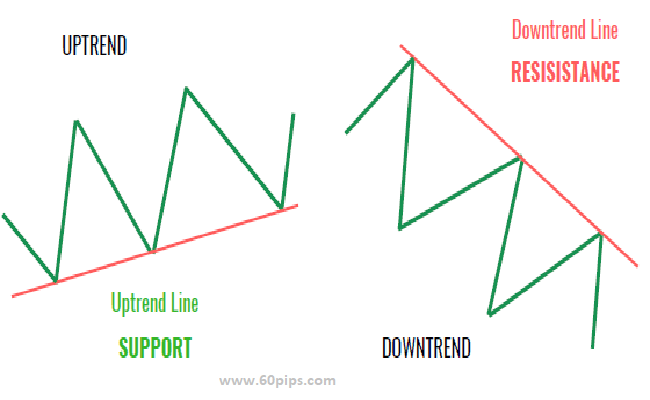

Identify the Trend: Determine whether the market is in an uptrend, downtrend, or ranging (sideways) trend. An uptrend consists of higher highs and higher lows, while a downtrend consists of lower highs and lower lows. A ranging market lacks a clear trend and moves within a horizontal price range.

Draw Trendlines: To draw trendlines, you need at least two significant points on the price chart. For an uptrend, draw a line connecting the lowest low points, and for a downtrend, connect the highest high points. In a ranging market, you can draw horizontal support and resistance lines.

Confirm the Trendline: Ensure that the trendline you’ve drawn touches as many significant points as possible. The more times the price touches the trendline without breaking it, the stronger the trendline becomes.

Entry Points: Look for opportunities to enter the market in the direction of the trend. In an uptrend, consider buying when the price touches or approaches the upward-sloping trendline. In a downtrend, consider selling when the price touches or approaches the downward-sloping trendline. You can also use additional technical indicators or price patterns to confirm entry signals.

Exit Points: Determine your exit strategy, which could include setting profit targets and stop-loss orders. In an uptrend, consider taking profits when the price reaches a resistance level or when a reversal pattern forms. In a downtrend, look for opportunities to exit near support levels or when reversal signals occur.

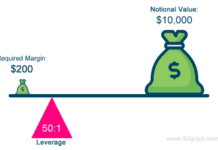

Risk Management: Always manage your risk by setting stop-loss orders to limit potential losses. Calculate your position size based on your risk tolerance and the distance between your entry point and stop-loss level.

Monitor the Trade: Keep a close eye on the market and adjust your trade as needed. Move your stop-loss to protect profits if the trend continues in your favor.

Trend Confirmation: To increase the probability of successful trades, consider using other technical indicators like moving averages, relative strength index (RSI), or MACD to confirm the prevailing trend.

Practice and Learn: Trendline trading requires practice and experience. Analyze your trades, both profitable and losing ones, to learn from your mistakes and refine your strategy.

Remember that no trading strategy is foolproof, and there are risks involved in trading financial markets. It’s essential to have a solid understanding of technical analysis, risk management, and discipline to implement a trendline trading strategy effectively. Additionally, staying informed about economic events and news that can impact the markets is crucial.

Click to sign up with ThinkMarkets

Related Articles:

FPMarkets Broker Review : Trading Services and Features