Gold is considered a valuable commodity for various reasons. It is a scarce resource with a finite supply, and its properties make it desirable for use in jewelry, electronics, and other industrial applications. Additionally, gold has traditionally been used as a store of value and a safe-haven asset during times of economic uncertainty.

As a commodity, the price of gold is determined by supply and demand dynamics in the market. When demand for gold increases, its price tends to rise, and vice versa. Gold prices can be affected by various factors such as economic conditions, political events, and currency fluctuations.

Investors can gain exposure to gold as a commodity through a variety of financial instruments, including exchange-traded funds (ETFs), mutual funds, and futures contracts. These instruments allow investors to participate in the price movements of gold without owning the physical metal. However, investing in gold carries risks, and investors should carefully consider their investment objectives and risk tolerance before investing in gold. Today’s Intraday Analysis overview on Gold as follows:

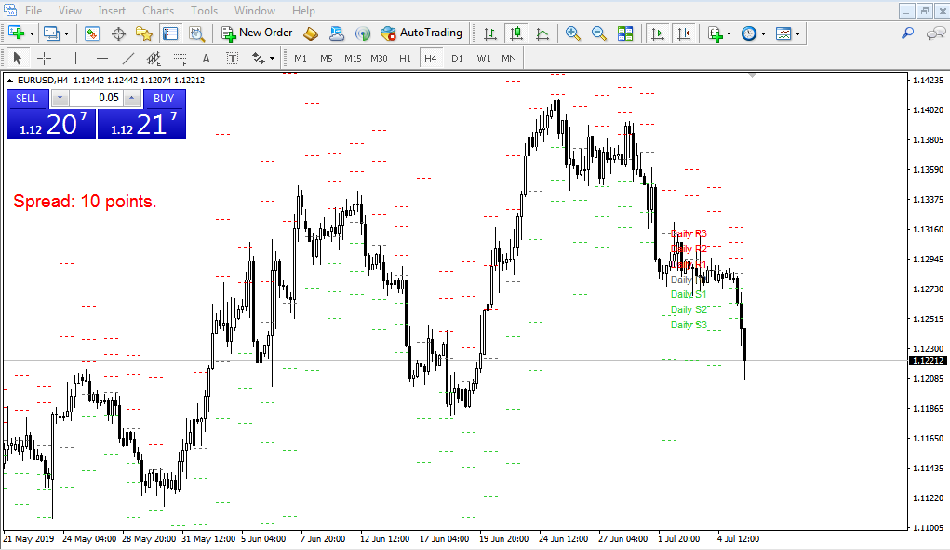

- The rally was sold and the dip bought resulting in mild net losses yesterday.

- Buying posted in Asia.

- Immediate signals are hard to interpret.

- Intraday, and we are between bespoke support and resistance 1817-1862.

- Broken out of the wedge formation to the upside.

- Preferred trade is to buy on dips.

Recommendation: Buy/Buy Limit @ 1818 Take Profit/Target: 1862

Related Post:

Broker Review: AvaTrade