The GBPCHF currency pair is a Forex trading pair that represents the exchange rate between the British Pound (GBP) and the Swiss Franc (CHF). In this pair, GBP is the base currency, and CHF is the quote currency. This means that when you look at the exchange rate, it tells you how much one British Pound is worth in Swiss Francs.

For example, if the GBPCHF exchange rate is 1.2500, it means that 1 GBP is equivalent to 1.2500 CHF. If the exchange rate moves to 1.2600, it would mean that the British Pound has strengthened against the Swiss Franc, as it now takes more CHF to buy 1 GBP.

Traders and investors in the Forex market use currency pairs like GBP/CHF to speculate on the future movements of exchange rates. They aim to profit from changes in the exchange rate by buying when they expect the base currency to strengthen or selling when they expect it to weaken relative to the quote currency.

It’s important to note that the Forex market is highly liquid and operates 24 hours a day, five days a week. Exchange rates in currency pairs like GBP/CHF can be influenced by a wide range of factors, including economic data, geopolitical events, central bank policies, and market sentiment. Therefore, traders often conduct thorough analysis and use various strategies to make informed trading decisions in this market.

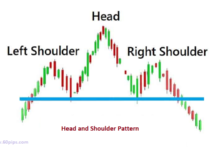

The RSI is below 50. The MACD is below its signal line and negative. The configuration is negative. Moreover, the pair stands below its 20 and 50 day moving average’s [Respectively at 1.23800 and 1.23900] Finally, the GBP/CHF has penetrated its lower Bollinger band (1.23670)

Recommendation: Sell/Sell limit @ 1.24100 Target: 60 pips

Click to sign up with ICMarkets

Related Articles:

gbpusd analysis on dated 16-9-2022