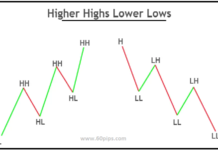

Choppy price action refers to a market condition where prices move up and down frequently, with no clear trend or direction. This can occur for a variety of reasons, including market uncertainty, geopolitical tensions, and changes in investor sentiment. Volatility, on the other hand, refers to the magnitude of price movements within a given period. Understanding choppy price action and volatility is critical for traders to make informed decisions and manage risk effectively.

Reasons for Choppy Price Action:

Market uncertainty and unpredictability are key reasons for choppy price action. Investors may be hesitant to make large trades or take on significant risks when there is uncertainty about the direction of the market. Geopolitical tensions and economic data releases can also contribute to choppy price action. For example, unexpected news about government policies or trade agreements can lead to significant price fluctuations. Additionally, changes in investor sentiment, such as sudden shifts in demand or supply, can cause prices to become choppy.

Effects of Choppy Price Action:

This type of price action can result in increased volatility and risk. With prices moving up and down frequently, it becomes difficult to predict future price movements accurately. This makes it challenging for traders to identify trends and make trading decisions. However, choppy markets can also present opportunities for short-term traders to profit from sudden price movements. While long-term investors may find choppy markets frustrating, short-term traders may see them as opportunities to make quick profits.

Strategies for Trading in Choppy Markets:

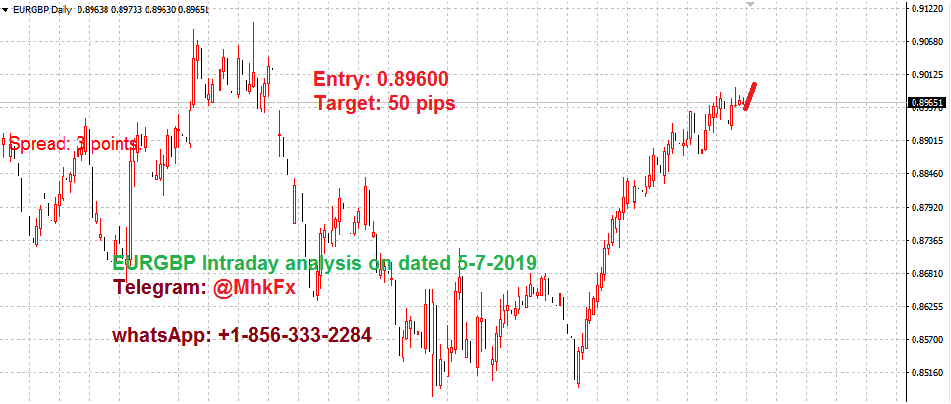

To navigate choppy markets successfully, traders need to adopt specific strategies. One approach is to focus on short-term trading strategies that take advantage of sudden price movements. Another strategy is to use technical analysis to identify key support and resistance levels, which can help traders make informed trading decisions. Stop-loss orders can also be used to minimize potential losses in case of sudden price movements. Diversifying your portfolio is another critical strategy that can help you minimize risks and protect your investments.

Conclusion:

Choppy price action and increased volatility are common market conditions that traders must learn to navigate effectively. By remaining disciplined, patient, and following a solid trading plan, traders can mitigate risks and take advantage of potential opportunities.

Choppy markets can be frustrating, they can also be profitable for those who know how to navigate them. Ultimately, traders who remain focused on their goals and execute their trading strategies with discipline and patience will be better equipped to navigate choppy markets and achieve success.

Related Articles:

Price Action in Stock Market