A forex broker is a financial services company that offers clients the ability to trade currencies, commodities, and other financial instruments. These brokers can be market makers or act as agents for execution.

When choosing a forex broker, it is important to consider several factors such as regulation, trading platforms, and the availability of educational resources. It is also important to ensure that the broker is a member of a regulatory body such as the National Futures Association (NFA) or the Financial Conduct Authority (FCA).

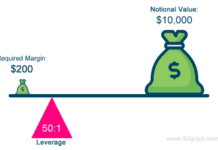

Forex trading is a highly leveraged activity, which means that traders can control large positions with relatively little money. This can lead to large potential profits, but also large potential losses. Therefore, it is important to use proper risk management techniques and to choose a reputable broker that offers negative balance protection.

Many forex brokers offer different types of trading platforms, such as the popular MetaTrader 4 and MetaTrader 5 platforms. These platforms offer advanced charting and technical analysis tools, as well as the ability to automate trades through the use of expert advisors.

Forex brokers also offer a variety of educational resources to help traders improve their knowledge of the markets. These resources include webinars, video tutorials, and trading guides. These resources can be particularly helpful for new traders who are still learning the basics of the forex market.

In conclusion, a forex broker is a company that offers clients the ability to trade currencies, commodities, and other financial instruments. Choosing a reputable broker with a strong regulatory record, good trading platforms and educational resources, and proper risk management tools is critical for success in forex trading.

Related Post:

ICMarkets : Broker Review as Trusted Trading