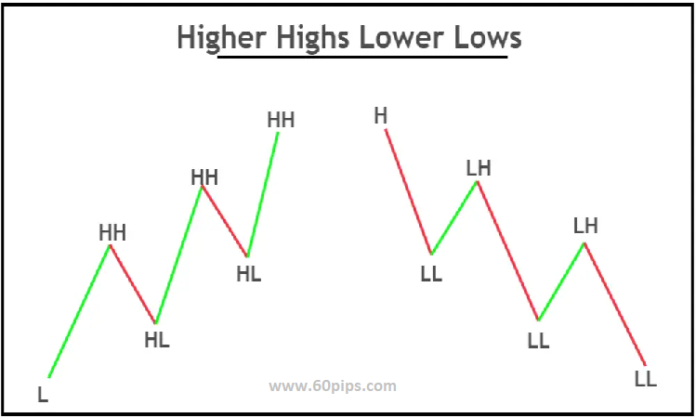

In forex trading, “lower low” and “lower high” are terms used to describe specific price patterns that can provide traders with valuable information about the direction of a currency pair’s trend. These patterns are often associated with technical analysis, which involves studying historical price charts and patterns to make trading decisions. Let’s break down what these terms mean:

Lower Low (LL): A lower low refers to a situation where the lowest price of a currency pair during a specific period (e.g., a trading session, day, week, or month) is lower than the lowest price reached during the previous period. It indicates that the bears (sellers) in the market have gained control, and prices are moving downward.

Lower High (LH): A lower high occurs when the highest price of a currency pair during a specific period is lower than the highest price reached during the previous period. This pattern suggests that the bulls (buyers) in the market are losing their grip, and prices are unable to reach the previous high levels.

Together, a lower low followed by a lower high is often a sign of a downtrend in the forex market. It indicates that each price rally (high) is weaker than the previous one, and each price decline (low) is lower than the previous one, demonstrating a potential shift in market sentiment from bullish to bearish.

Here’s how traders might interpret and use these patterns:

Downtrend Confirmation: When a currency pair forms a lower lows and lower highs, it can be seen as confirmation that the market is in a downtrend. Traders may consider selling or shorting the currency pair to profit from the downward movement.

Entry and Exit Points: Traders may use lower lows and lower highs to identify potential entry and exit points for their trades. Entering a short position (selling) after a lower high has formed can be a strategy to catch a downtrend early, while exiting a long position (if applicable) might be considered when a lower high is established.

Stop Loss and Take Profit: Traders often use these patterns to set stop-loss orders to limit potential losses and take-profit orders to secure profits at predefined levels. These orders are placed based on the analysis of lower lows and lower highs.

It’s important to note that while lower lows and lower highs can provide valuable insights, they should be used in conjunction with other technical and fundamental analysis tools and indicators to make well-informed trading decisions. Additionally, trading in the forex market carries inherent risks, and traders should have a solid risk management strategy in place to protect their capital.

Click to sign up with MonetaMarkets

Related Articles:

Fund Management Offer