There are some general information about gold analysis. Gold analysis involves the examination and assessment of various factors related to the price, value, and trends of gold. Before start trading you need to Xauusd Technical analysis then. Here are some key points to consider:

Supply and Demand: The basic principles of economics apply to gold as well. Changes in supply and demand can significantly impact the price of gold. Factors like mining production, geopolitical instability in major gold-producing regions, and changes in jewelry demand can all influence the supply-demand dynamics.

Macro-Economic Factors: Gold is often seen as a safe-haven asset, meaning its value can increase during times of economic uncertainty or market turbulence. Factors like inflation rates, interest rates, currency fluctuations, and overall economic stability can impact gold prices.

Central Bank Reserves: Many countries hold significant amounts of gold as part of their foreign exchange reserves. Announcements or changes in these reserves by central banks can influence gold prices.

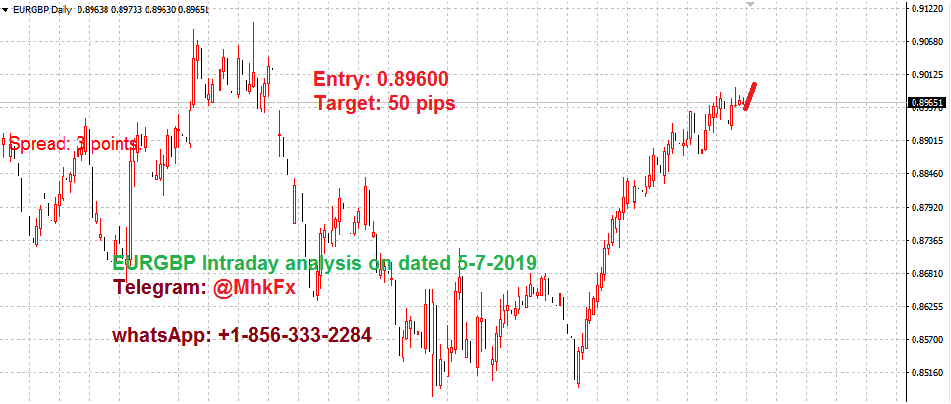

Technical Analysis: Traders and investors often use technical analysis to study historical price and trading volume patterns to predict future price movements. This involves looking at charts, trends, and various technical indicators to make informed decisions.

Fundamental Analysis: This involves assessing the underlying factors that might influence gold prices, such as mining costs, global economic indicators, and overall market sentiment.

Investor Sentiment: Public perception and sentiment play a role in gold prices. If investors believe that economic conditions are deteriorating, they might turn to gold as a safe-haven investment, driving up its price.

Jewelry Demand: A significant portion of gold demand comes from the jewelry industry. Trends in fashion and consumer preferences can impact the demand for gold in this sector.

Industrial Use: Gold is used in various industries, including electronics and dentistry. Changes in industrial demand can also affect gold prices.

Geopolitical Factors: Political instability, conflicts, and trade tensions can impact gold prices as investors seek to hedge against uncertainty.

Monetary Policy: Changes in monetary policy by central banks, such as quantitative easing or interest rate adjustments, can influence gold prices.

Mining Costs: The cost of gold production can impact the supply side of the equation. If production costs rise significantly, it might lead to reduced supply and potentially higher prices.

Global Events: Major events like financial crises, natural disasters, or pandemics can have far-reaching effects on financial markets, including the price of gold.

It’s important to note that the price of gold can be influenced by a complex interplay of these and many other factors. Predicting gold prices accurately is a challenging task, and many experts use a combination of both fundamental and technical analysis to make informed assessments. As with any financial analysis, it’s important to stay updated with current events and market trends. Today’s Xauusd Technical analysis overview as follows:

- The rally was sold and the dip bought resulting in mild net gains yesterday.

- The bias remains mildly bullish but there is scope for a move in either direction at the open.

- Bespoke support is located at 1885.

- The previous swing low is located at 1884.

- Preferred trade is to buy on dips.

Recommendations: Buy/Buy limit @ 1896 Take Profit: 1916

Read more : Exclusive Forex Signal Offer for IB Users : Boost Your Trading Success Today!