When analyzing trading in XAU/USD (Gold/US Dollar) or any other financial instrument, traders consider various factors to make informed decisions. These factors can be broadly categorized into fundamental and technical analysis. Here are some key factors to consider:

Fundamental Analysis:

Economic Indicators: Watch for economic indicators such as GDP growth, inflation rates, employment data, and interest rate decisions. These factors can impact the value of the USD and, in turn, affect the XAU/USD pair.

Central Bank Policies: Pay attention to the monetary policies and statements from the Federal Reserve (Fed) and other central banks. Changes in interest rates and quantitative easing measures can influence the strength of the US Dollar.

Geopolitical Events: Political instability and international tensions can impact safe-haven demand for gold as investors seek a safe place to store value.

Market Sentiment: Monitor the overall market sentiment and risk appetite. When risk aversion increases, investors may turn to gold as a safe-haven asset.

Technical Analysis:

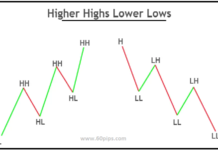

Trend Analysis: Identify the prevailing trend of the XAU/USD pair using various technical indicators and chart patterns. Trends can be upward, downward, or sideways.

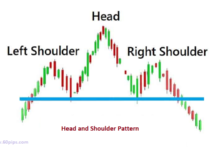

Support and Resistance Levels: Look for significant support and resistance levels on the price chart. These levels can indicate potential turning points for the asset’s price.

Moving Averages: Use moving averages (e.g., 50-day, 200-day) to identify trend reversals or confirm the strength of a trend.

Oscillators and Indicators: Implement oscillators (e.g., RSI, MACD) and other technical indicators to spot overbought or oversold conditions and potential price reversals.

Volume Analysis: Analyze trading volume to confirm trends and detect potential trend reversals.

Market Sentiment and News:

Stay updated with financial news and market sentiment. Major news events can cause significant price movements and shifts in investor sentiment.

Risk Management:

Always incorporate risk management principles into your trading strategy. Determine the appropriate position size, set stop-loss levels, and manage your capital prudently.

Remember that trading involves inherent risks, and no analysis can guarantee profits. It’s essential to combine these factors with your trading experience, knowledge, and intuition to make well-informed decisions. Additionally, be cautious of relying solely on past performance, as market conditions can change rapidly, and historical data may not predict future outcomes accurately.

Today’s trading overviews as follows:

- Continued downward momentum from 1972 resulted in the pair posting net daily losses yesterday.

- There is no clear indication that the downward move is coming to an end.

- Price action has formed an expanding wedge formation.

- The trend of lower lows is located at 1933.

- A Fibonacci confluence area is located at 1936.

- Dip buying offers good risk/reward.

Recommendations: Buy/Buy limit @ 1938 Take Profit: 1978

Related Post: ThinkMarkets : A Global Forex Broker with Competitive Spreads and Advanced Trading Platforms