Price action is a trading approach that involves analyzing and making decisions based on the price movement of financial instruments, such as stocks, commodities, or currencies, rather than relying on indicators or fundamental analysis.

It involves studying past market data to identify and understand market trends, and make predictions about future price movements. Traders believe that all relevant information is reflected in the price of a security, and that technical analysis of price patterns and trends can provide valuable insight into future market behavior.

Price action is a widely used technical analysis approach in the stock market. It is a method of evaluating securities by analyzing the price and volume of their trades, rather than relying on other indicators, such as moving averages or oscillators.

Price action traders believe that all relevant information, such as economic and market conditions, is reflected in the price and volume of trades, and that by analyzing these data points, they can identify trends and make predictions about future price movements.

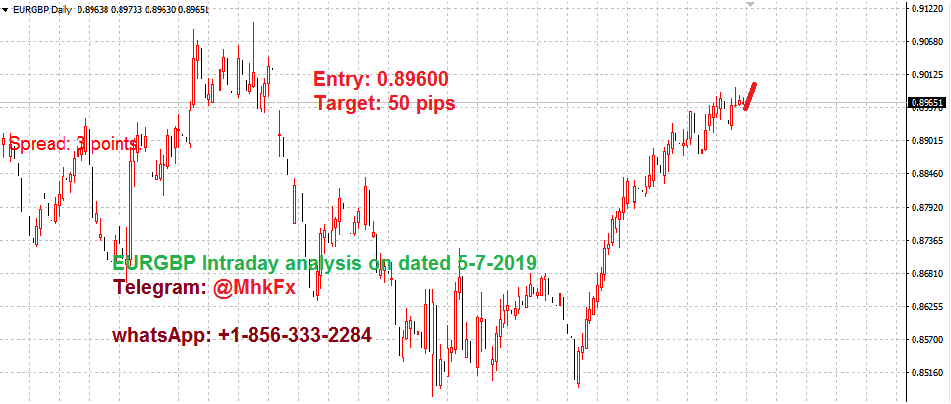

In the stock market, traders typically focus on charts, using different time frames and chart patterns to analyze the price and volume of trades. Common chart patterns used in price action analysis include head and shoulders, triangles, and trend lines. Price action traders also pay close attention to support and resistance levels, which are levels at which the price of a security has historically experienced significant buying or selling pressure.

One of the benefits of using price action in the stock market is that it is a relatively simple approach, requiring only basic charting tools and an understanding of price patterns. This simplicity makes it accessible to a wide range of traders, from beginners to more experienced traders. Additionally, traders do not need to keep up with a large amount of data, as they focus solely on the price and volume of trades.

Another advantage of price action is that it can provide a clear and unbiased view of the market. By relying solely on the price and volume of trades, traders can avoid the potential biases that can be introduced by indicators or other forms of analysis. Additionally, price action is a reactive approach, meaning that it reacts to market conditions in real-time, rather than trying to predict future events.

Price action is not without its drawbacks. It can be challenging to determine the significance of price patterns and trends, as they can sometimes be ambiguous or subject to interpretation. Additionally, traders may miss out on important market information that is not reflected in the price and volume of trades, such as changes in company fundamentals or economic conditions.

Price action is a widely used and versatile approach to technical analysis in the stock market. While it has its limitations, it provides a simple and effective way for traders to analyze the market and make predictions about future price movements. By focusing solely on the price and volume of trades, traders can gain valuable insights into market trends and make informed trading decisions.

Related Post:

Choppy Price Action Continues as Traders Brace for Increased Volatility